Is Nexo worth the hype? Discover the good, the bad, and the outright amazing aspects of Nexo.io. So, use this opportunity to make an informed decision concerning your future with Nexo

- The Nexo online platform is user-friendly.

- The Nexo card makes it easy to access funds in the Nexo wallet.

- Client funds are secured and insured.

- Nexo.io offers affordable interest rates on both loans and deposits.

- Nexo supports over 45 fiat currencies and 12 cryptocurrencies.

- Margin calls are possible in case the value of your cryptocurrency security drops.

- Nexo.io offers limited interest on cryptocurrency deposits.

- Proof of identity is a must, making it unsuitable for people who prefer to remain anonymous in the crypto-exchange space.

Is Nexo Safe for Your Cryptocurrency? Find Out! (Updated 2020 Review)

Is Nexo worth the hype? Discover the good, the bad, and the outright amazing aspects of Nexo.io. So, use this opportunity to make an informed decision concerning your future with Nexo.

Summary Review of Nexo.io

How does Nexo.io Mark out of 5?

| Marking Points | Marks |

| Support | 4.0/5.0 |

| Rates | 4.5/5.0 |

| Loyalty | 4.5/5.0 |

| Customer Reviews | 4.0/5.0 |

| Total | 4.25/5.0 |

Nexo Interest Rates

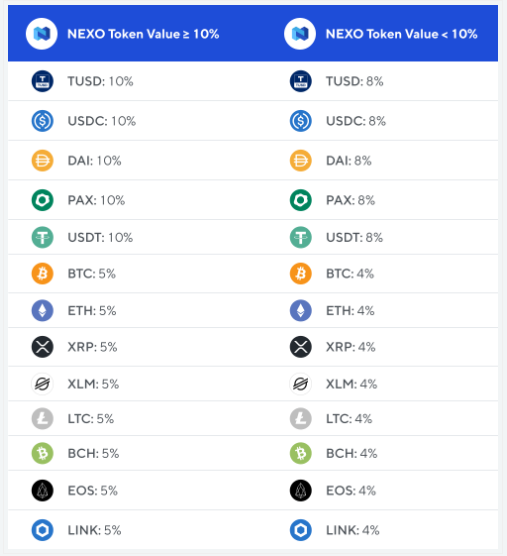

From the company website, I found out that upon every fiat currency deposit you make at Nexo, you get 8% interest per year. What’s more, the interest rates rise as high as 10% per annum. I wondered why? It was interesting to note that to start earning 10% interest on your Nexo GBP and EUR currency deposits, you have to save up Nexo tokens with a value of 10% of your crypto backing in Nexo’s Savings Wallet and deposit at least GBP 1,000 or EUR 1,000. Huh?

What’s more, Nexo claims that it differs from other companies in the crypto lending space because the interest is paid daily. The benefit of an interest earned daily is that the initial principal amount in your account increases daily. Hence, the compounded principal leads to higher interest returns than if the company paid simple interest. But is that a sober claim of value? Almost all savings accounts including those in conventional banking pay interests daily.

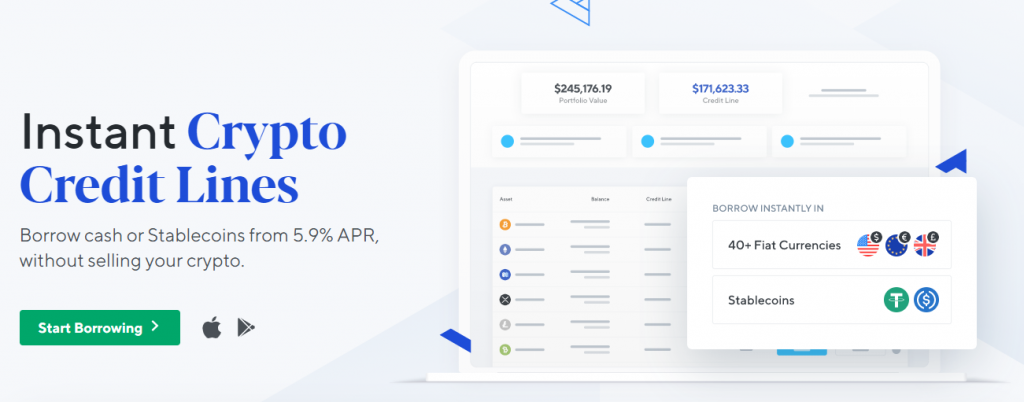

Nexo Loan Rates

The firm mentions that its loans attract fixed interest rates with APRs of 5.9% or 11.9%. Why would one interest rate be almost half the other?

The interest rate Nexo applies to loans depends on your usage of the Nexo token. If you use the Nexo token to repay your loan or if part of your cryptocurrency security is in the form of the Nexo Token, you get to enjoy the 5.9% APR interest rate. However, if you do not use the Nexo token either in your crypto backing or in repayments, then you are subject to an 11.9% APR interest rate on your loan.

The finding made me feel like Nexo is forcing its clients into their Nexo Token product. Because, why would you tie your product to interest rates on both deposits and loans? Do not worry if you are not well-informed about the Nexo Token concept because we will explain it to you in this review.

1. An overview of Nexo.io / Overview?

Nexo is an online platform in the lending business. The firm specializes in the crypto space by loaning individuals with cryptocurrencies as security.

Have you ever found yourself holding cryptocurrency but urgently needed money for whatever use, while at the same time not being willing to sell your crypto coins? If yes, then Nexo claims to have the solution for you. The blockchain company offers a unique service that allows ordinary people and businesses to borrow money in common fiat currency while using cryptocurrency deposits as security.

But the pressing question is, is the solution worthwhile? Are there any hidden traps? Does Nexo.io have any scam concerns? I sought to find answers.

What is Nexo’s portfolio?

One method I use to evaluate the reliability of any business, especially those offering services, is their portfolio. You will agree that experience and numbers do not lie, right? Well, according to the Nexo.io website, the company was founded in 2007 and has grown to become the most trusted digital asset lending firm. Through the 13 years, Nexo has operated, Nexo claims that it has attracted over 800,000 clients residing in over 200 countries. Also, Nexo mentions that it has processed loans above $3 billion, with a large percentage of processed financing having been accomplished in the last two years.

Who owns and manages Nexo?

I have come to conclude that companies that do not hide founding and ownership information are trustworthy. Based on my analysis, Nexo gets a thumbs up. The company clearly states that it was founded by the leading Fintech group Credissimo. However, on May 7, 2014, Nexo conducted its Initial Public Offering (IPO), where 2.5 million shares were listed to the public market. Currently, Nexo is led by Antony Trenchev.

How safe is the Nexo Online Platform?

Perhaps you may ask, is Nexo.io safe? Nexo.io describes itself as a safe crypto asset-based lender. According to the company’s website, the safety of the Nexo online platform is described as military-grade through the unique 256-bit encryption. Based on my understanding of the crypto industry, security is rarely a one-man show; firms in the crypto space delegate security functions to third-party firms specializing in data security. I found that Nexo is no exception, BitGo guarantees the safety of client funds at Nexo. It may be significant to note that BitGo is SOC 2 compliant and backed by Goldman Sachs.

2. Nexo Pros and Cons in Detail

Pros

- A wide variety of currencies supported

Nexo.io offers its users a wide variety of fiat and cryptocurrencies for deposits and withdrawals. As of July 2020, Nexo supports more than 45 fiat currencies and 12 popular cryptocurrencies namely; XRP, LTC, BTC, ETH, XLM, BCH, EOS, NEXO, BNB, LINK, stablecoins, and PAXG.

- A secure Nexo Card

Who doesn’t like the flexibility and ease of access to one’s cash that cards offer? However, we are all concerned about the card’s security. Concerning the Nexo card, I was impressed to find out that an individual can manage the Nexo Card through the Nexo App. For that reason, in case you lose the card, you can lock the card from the app rendering it inactive.

- Insurance

For all financial institutions with online platforms, security can never be over emphasized. Nexo is no exception! The security of your funds is enhanced through insurance on fiat and cryptocurrency deposits. For every wallet, Nexo has an insurance limit of $100 million.

- Security

Even though Nexo safeguards your funds through insurance the firm has evidently toughened the security details of its systems. As a result, I consider the chances of the military level Nexo security features being hacked to be meager given that the cold storage is in SOC 2, Class III vaults. Also, Nexo informs that its information security management systems are compliant with ISO/IEC 27001:2013, which further ascertain Nexo’s commitment to security. That’s a plus!

- User-friendly interface

Nexo.io provides clients a highly interactive and user-friendly website and application. Regardless of whether you are an expert or a newbie in the vast world of crypto, I feel Nexo has made it easy to transact with them. I tried to get help by asking if I could get a loan immediately and I deposited bitcoins. I was impressed that I was redirected to a page with similar questions. You may ask why they do not do direct online chats. From personal experience, I feel online live chats should not be direct to filter serious clients from jokers.

- High interests on deposits and low-interest rates on loans

As discussed earlier, Nexo has a competitive interest rate package. With a minimum annual return of 8% and up to 10% on EUR and GBP deposits, I consider the interest rate way better than if you had to leave your cash in a conventional bank savings account. What’s more, Nexo charges zero fees on both the deposits and interest proceeds.

When taking the no-credit-check loan with Nexo, you will yield interest at a rate of either 5.9% or 11.9% APR. The secret to less Nexo loan interest rate is using the Nexo Token in payments or as crypto backing.

Cons

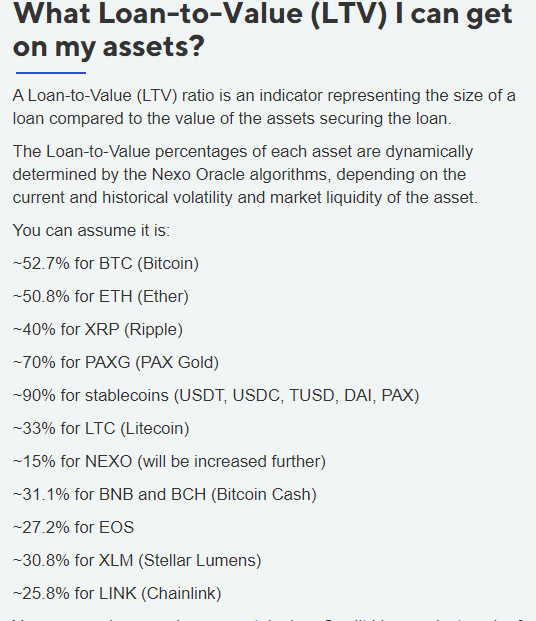

- Margin Calls

I hate margin calls. They make me tense. Given that the security to your loan at Nexo is the cryptocurrency deposit, there is a high likelihood that you may get a margin call should the value of the crypto backing drop, which drops your Loan to Value (LTV) ratio at Nexo. In that case, you will receive 3 margin calls at 71.4%, 74.1%, 76.9%. Nexo is forced to liquidate some of your cryptocurrency to avoid losses. Remember you took the Loan to avoid selling your coins in the first place. Disgusting, isn’t it?

- Limited interest on Crypto deposits

Do you remember the Nexo Token trap on Nexo interest rates we discussed earlier? Well, Nexo also needs you to have Nexo Tokens to earn sensible interests on your cryptos. Another pathetic forceful marketing tactic.

- Limited anonymity

We all love the crypto space because of the anonymity it offers. However, with Nexo, anonymity is limited, especially when you need a loan above $10,000. Nexo.io offers two verification levels. Loans less than $10,000 require basic verification of personal information without any documentation. For loans over $10,000, you will need advanced KYC verification that entails uploading your photo, Driver’s License, Passport, or a kind of National Identity card.

3. Nexo.io Services

In my quest to find out what are the top Nexo.io services, I established that Nexo offers two main services – Nexo Earn Interest Service and Nexo Loan Service.

Nexo Earn Interest Service

How does Nexo Earn Interest work?

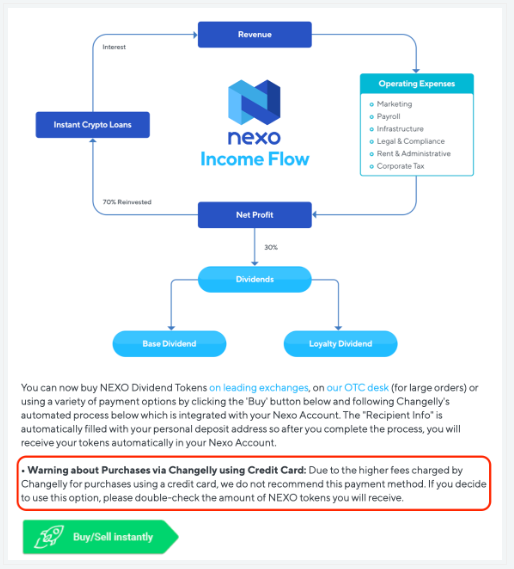

The Nexo interest service is a product in which Nexo aims at motivating investors to deposit funds into their Nexo wallets through which Nexo gets funding for their Nexo Loan Service. In return, clients are guaranteed a share of loan returns in the form of interests or dividends. As a Nexo deposit client, you may choose to invest in either one or any combination of the following three options in the Nexo Earn Interest Service:

- Nexo fiat currency interest.

- Nexo Token advantage.

- Nexo Cryptocurrency interest.

Nexo Fiat Currency Interest

In the Nexo Fiat Currency interest service, you get either 8% or 10% interest per annum on your Nexo Wallet deposits. But how does Nexo make money so that it can pay you such benefits? The answer lies in the loans Nexo offers its clients and the guaranteed asset backing on which the credits are awarded based on the LTV ratio of the particular asset.

Nexo Token Advantage

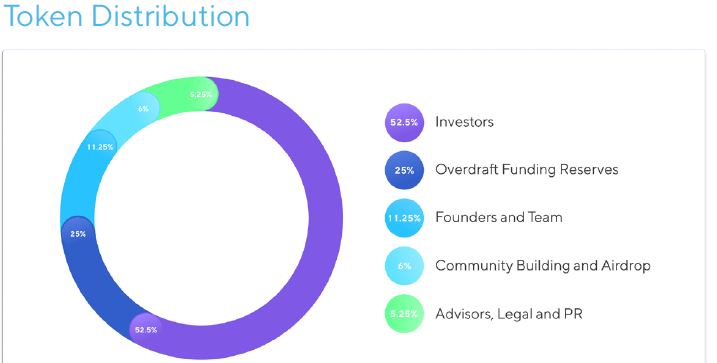

In my view, the Nexo token exists as a form of extending the Nexo crypto reach in the public. Why then would a firm tie its product to determining interests on loans and deposits? But first, what is the Nexo Token? The firm describes its Nexo token as a live utility token product with a par value of $0.10 claiming it offers multiple utility benefits and features to investors. Why should you bother to invest in Nexo Tokens? I realized that apart from the 30% dividends investors earn from Nexo’s annual profits, being a Nexo Token investor has two value drivers. First, you can use the Nexo Token in the Nexo wallet as backing for loan financing. Secondly, once you secure your loan, you repay the loan at a discounted 5.9% APR interest rate, while retaining your Nexo Token. While it is a good and creative product, I feel Nexo should invest in marketing the Nexo Token rather than tying it to its interest rates.

Nexo Crypto Currency Interest

The interest service on cryptocurrency deposits is relatively new at Nexo. To earn interest on your crypto assets at Nexo, you must have Nexo Tokens. I feel disgusted every time I write the Nexo Token requirement for interest benefits.

How is the Nexo interest calculated?

The percentage of Nexo Tokens compared to the free crypto assets in your account will determine the annual percentage yield (APY) or Nexo interest of your crypto savings. In essence, Crypto assets used as collateral for loans in the Credit Line wallet are invalid when calculating the Nexo Token value percentage.

Evidently, you must have at least 10% Nexo Token value to enjoy a higher APY on your crypto assets. Therefore, if you wish to earn interest on your idle crypto assets with Nexo, you need to learn how to buy Nexo Tokens, right?

How Do You Buy Nexo Tokens?

Given the forced benefits of having Nexo Tokens, it would only be fair if we delved into the nitty-gritty of buying Nexo Tokens. According to a detailed guide on how to buy Nexo Tokens on Nexo.io, here is a summary of the steps:

Step 1: Once Logged into your Nexo account, Click on “Buy Nexo.”

Step 2: Move to the “Buy/Sell instantly” button while being attentive to the issued warning.

Step 3: Give details of the Crypto asset you would like to use in exchange for the Nexo tokens.

Step 4: Click on “Swap now,” where you will be directed to a pre-populated Nexo wallet.

Step 5: Provide your email address and check your mailbox for a verification message and request to set your password.

Step 6: Key in your desired password and click the “Proceed” button.

Step 7: In the page, you get redirected, click on “Copy.”

Step 8: Paste the copied information in the “withdraw to” tab in the next field.

After that, you will receive a confirmation message that the Nexo Tokens have been added to your Nexo wallet.

Nexo Loans

The Nexo Loan service provides clients with cash using the client’s crypto asset as security. Hence, clients get to access finance without selling their crypto assets. What’s more, Nexo does not conduct any credit checks on its borrowers because they hold the crypto assets in the Nexo wallets as security.

How do Nexo Loans work?

Due to the risks involved in lending, Nexo Loans work by calculating the amount a client can comfortably pay back using the client’s crypto-asset LTV ratio.

A concern is where a client wants to get a higher loan limit. Interestingly, there is no shortcut. The only solution would be to deposit more crypto assets into your Nexo Wallet to improve your LTV ratio.

Nexo Loan interest rates

Before we get into the loan interest at Nexo, it may be important to note that Nexo.io offers borrowers a minimum loan amount of USD 500 and a maximum of USD $2,000,000 as long as the borrower’s LTV ratio allows. Once the loan is processed, Nexo charges a loan interest rate of 5.9% or 11.9% per annum. The different rates are applied based on a client’s usage of the Nexo Tokens.

I found it interesting that the interest on the loan is charged based on the amount you use from the loan. That is to say, in case you are awarded a loan and you do not withdraw the whole of it, you only get charged interest on the amount withdrawn from the loan.

When is the first payment due?

Nexo.io does not have a minimum amount of loan repayments. However, Nexo remits the interest from your collateral or credit limit should you fail to make loan repayments. According to the Nexo Help Center, Nexo loans have a maturity period of 12 months upon which the elapse of the first 12 months yields an extension of another 12 months. They already have your crypto assets after all. That is good customer relations right there, Nexo!

Are there any tax benefits with Nexo Loans?

Yes. By the way, anything that saves on tax captures my interest, any day! Have you ever heard of tax on capital gains? If you conventionally sold your crypto assets at a profit to raise cash for your pressing need, you would have to pay tax on the benefit gained. However, in the case of using your crypto assets as collateral for your loan, you save yourself from paying tax on capital gains.

The concept is what the late Steve Jobs applied to avoid paying substantial tax bills. With his infamous $1 salary, he would use his 5.5 million Apple shares as security to get loans for lifestyle sustenance. Therefore, if you are looking at minimizing the amount you would pay in taxes for liquidating your crypto assets, use the coins as security for a loan.

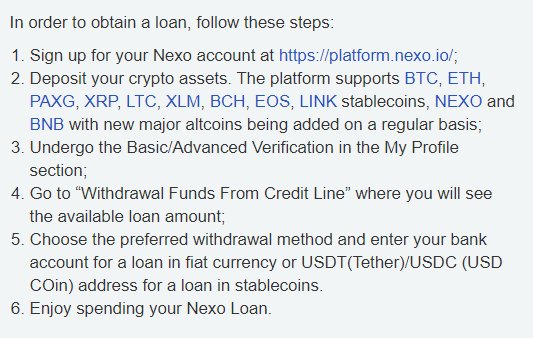

Steps to a Nexo Loan

Getting a Nexo loan is fast and almost instant. I found the following six steps to getting your Nexo wallet credited with a loan:

4. Is Nexo legit / Nexo Guarantee?

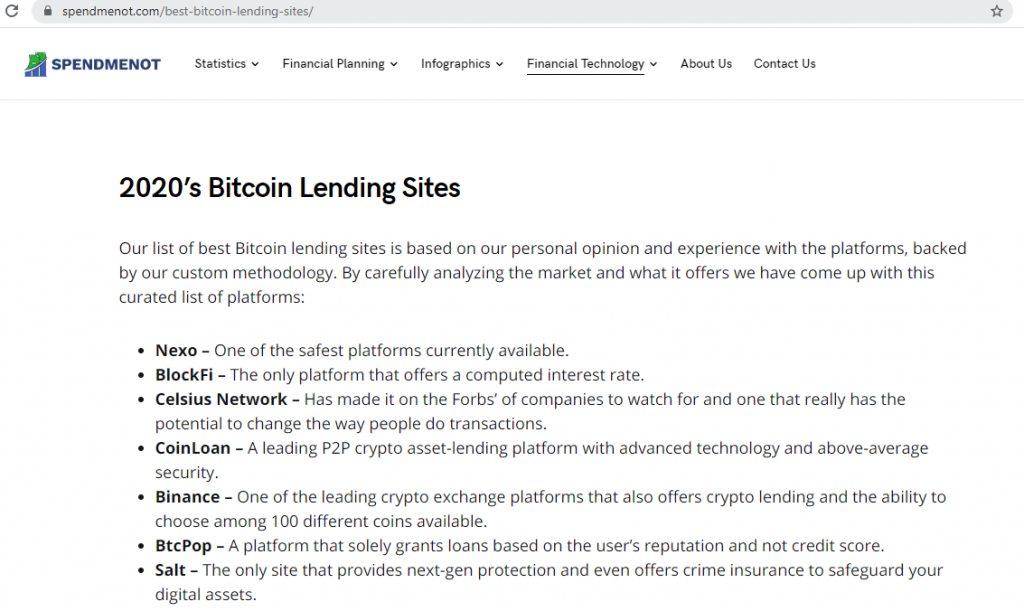

In as much as the crypto market is marred with all kinds of scams, Nexo.io stands out. A quick google search hints that Nexo is a legit crypto lending company and is ranked among the best lending sites with safety being a major plus.

Also, the firm claims that Nexo is fully regulated and licensed in the crypto loan space fulfilling the following:

- Nexo’s operational capital is adequate.

- Nexo conducts internal and external audits regularly.

- Nexo has put in place sober Anti-money laundering (AML) measures.

- Nexo has ensured the security of its data systems.

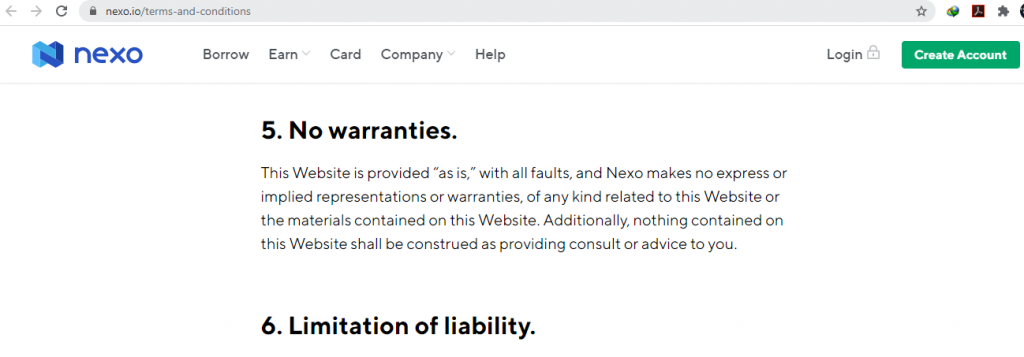

But, the “No warranties” element in Nexo’s terms of service raises eyebrows. Unless otherwise, I understand the clause to mean that whatever I understand from the contents of the Nexo website is up to me. I feel that is not right. Nexo ought to build the user’s confidence in the contents of their website.

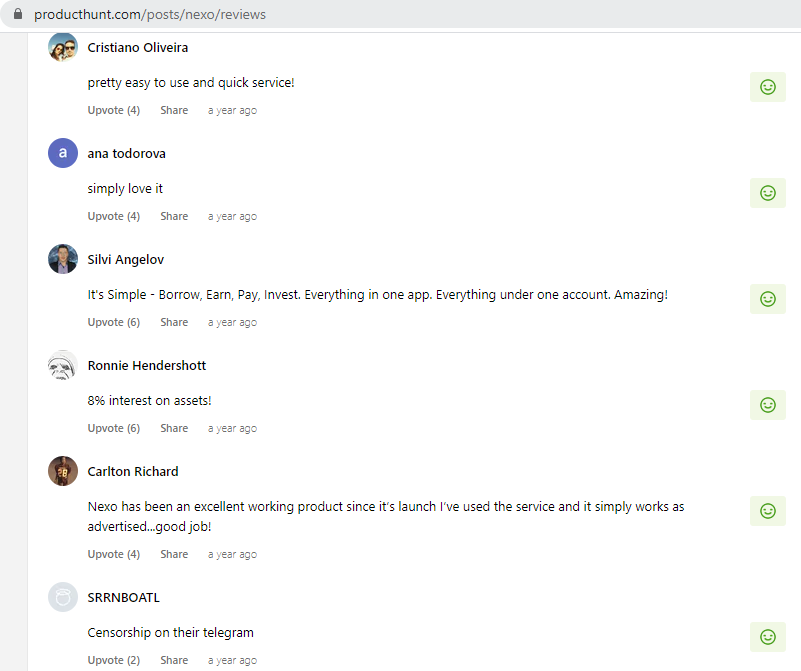

5. Customer Reviews

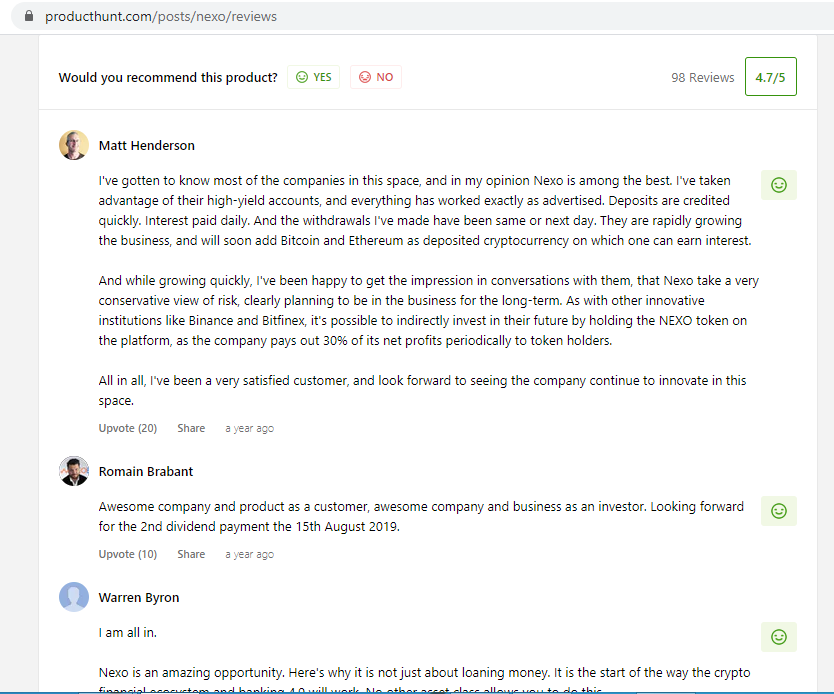

I love the word of mouth since user experience tells it all! A Google check on what Nexo customers have to say about the company shows that Nexo.io is a legit and reliable firm. However, freedom of expression is limited to the Nexo telegram handle. Therefore, based on the review rating of 4.7/5 as an average of 98 reviews, I conclude that Nexo is a worthwhile investment opportunity and lending service.

6. FAQ HERE

7. Nexo Versus Other Crypto Loan Providers

How does Nexo compare to other lenders in the crypto space? I want to make your comparison easy. While researching this review, I compared Nexo with other companies from the financial benefit point of view and summarised my findings through the table below.

| Nexo | Celcius Network | BlockFi | Coinloan | |

| Supported cryptos | 12 | 7 | 6 | 7 |

| Min. loan amount | $500 | $1,000 | $2,000 | Unspecified |

| Max. loan amount | $2,000,000 | Could not find | $,10,000,000 | Unspecified |

| Interest on loan (APR) | From 5.9% | From 3.47% | From 4.5% | From 4.5% |

| Interest on fiat currencies (APY) | 8% to 10% | Could not find | Could not find | Could not find |

| Interest on crypto | Upto 10% | Upto 12% | Upto 8.6% | Upto 10.3% |

| Credit checks | No | No | No | No |

| Insurance | Upto $100m through BitGo | Upto $100M through BitGo | None | None |

| Card | The Nexo Card | None | BlockFi Credit Card | Could not find |

There you go! From the above table, you can make your judgments after comparing Nexo to BlockFi, Celsius Network, and Coinloan. It is clear that no one company has all the best features. Therefore, it all depends on what you want or what matters most to you.

8. Verdict

To be honest, I get an adrenaline rush every time I review an online service and find out it is a scam. On that merit, I could not find a serious scam allegation about Nexo in my search for reviews. As such, my take is that Nexo is a reputable and safe firm given its experience, portfolio, and largely positive user experiences. Some of the outstanding features about Nexo include:

- High yield interest of up to 10%.

- Military-grade security.

- $100,000,000.00 insurance

- Multi-asset support.

- Truly a global platform.

- Avoid capital gains taxes.

- Thousands of happy Nexo customers

However, I am not impressed by Nexo’s repeated intertwining of its Nexo Token product with interest rates. I consider that akin to arm twisting clients to owning Nexo. I feel the dividend package is a sufficient value driver since Nexo has a value and when one feels like they’ve had enough of it, they can sell it.

All in all, would I save at Nexo or borrow from them? Absolutely! Because I value the security and insurance of my money. Would I recommend you to invest or borrow from Nexo? Well, I did my part giving you this review, including giving you a brief overview of what other cryptocurrency lenders have to offer. Make your informed decision alone. See you in our other review articles!