BlockFi, founded in August 2017, is one of the first privately-held NYC-based lending startups in the cryptocurrency markets. It allows cryptocurrency holders to efficiently use their digital assets around with market volatility, by either earning interest on or take a loan against your Cryptocurrencie.

- Easy registration

- Trading and lending benefits

- Competitive interest on deposits and savings

- Maximum security

- Universal access unless sanctioned by your particular country

- Easy withdrawals

- Default or counterparty risk on lending money

- No instant withdrawals

- Variable interest rates on investment

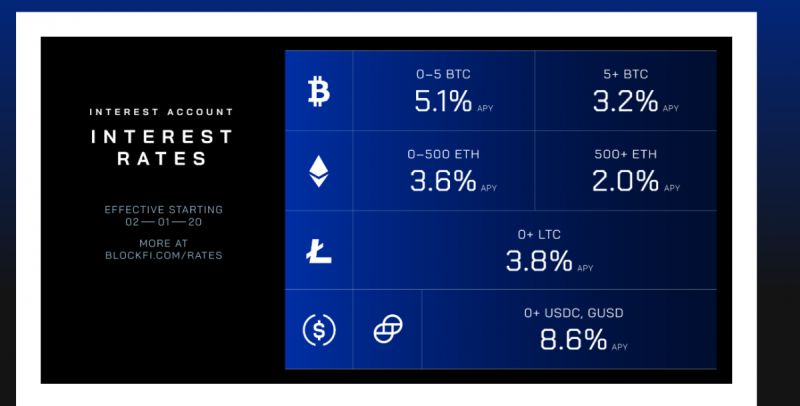

BlockFi Interest Rates:

What is BlockFi?

BlockFi, founded in August 2017, is one of the first privately-held NYC-based lending startups in the cryptocurrency markets. It allows cryptocurrency holders to efficiently use their digital assets around with market volatility, by either earning interest on or take a loan against your Cryptocurrencies.

BlockFi has a strong leadership team with up to 70+ members comprising of Zac Prince (Founder & CEO), Flori Marquez (Co-Founder & VP of Operations) and Rene Van Kesteren (Chief Risk Officer), and people mainly from the USA, Argentina and Poland.

The company has a total funding amount of up to $78.7M, and their money-making aim depends on the amount of capital borrowed at a lower interest rate and lends at a higher rate.

How does BlockFi work?

BlockFi makes money by either lending the crypto assets to other institutions for trading or directly lending cryptocurrency. Borrowers of these assets include Traders and investment funds, Over the counter (OTC) market makers and enterprises that provide liquidity to clients through crypto inventory.

As an independent market leader, BlockFi is backed by venture capitalists like Valar Ventures, Winklevoss Capital, Galaxy Digital, Susquehanna, Akuna Capital and other big names in the industry. It recently raised around $18.3 million in a funding program led by Valar Ventures, SoFi and Purple Arch Ventures. Although there exist no charges on trading this could be yet another scope for the firm to expand into in future.

BlockFi aims to build a sustainable company that will exist in the long term. They do not hold tokens to maintain a certain interest rate. The BlockFi app additionally differentiates itself by paying compound interest, unlike competitors who pay simple interest. This means that at BlockFi, you tend to accrue the interest daily thus compounding it every month.

Pros and Cons

There are various advantages of using BlockFi app.

- Easy registration

- Trading and lending benefits

- Competitive interest on deposits and savings

- Maximum security

- Universal access unless sanctioned by your particular country

- Easy withdrawals

The BlockFi functions its Interest account, which allows cryptocurrency to pay competitive interest and offer rates compared to non-crypto currency interest rates. BlockFi further offers loans that are backed by your cryptocurrency with up to 50% LTV ratio.

Despite the advantages, BlockFi has several disadvantages too.

- Default or counterparty risk on lending money

- No instant withdrawals

- Variable interest rates on investment

BlockFi interest rate also fluctuates every month or so, creating risk.

BlockFi’s services

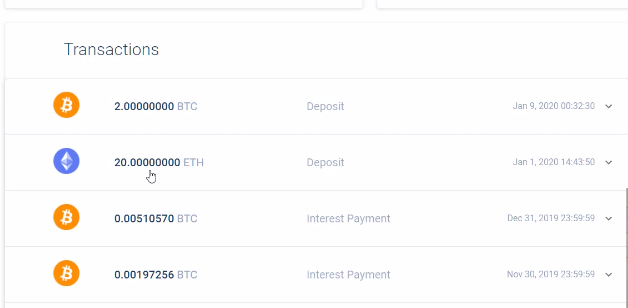

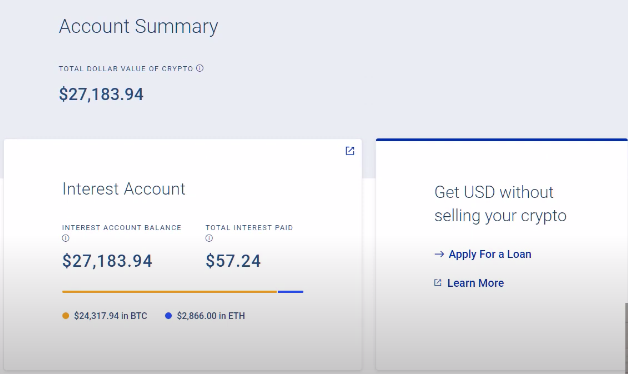

The BlockFi interest account allows users to earn interest on cryptocurrencies such as bitcoin, ether litecoin and more. The only requirement is to store the crypto at BlockFi and you can start earning interest.

How does it work?

Like a bank account where you can earn interest on money invested. Similarly, BlockFi account allows you to earn interest on the cryptocurrencies. After providing the relevant details you can go through your investments and the interests on it.

How is BlockFi interest calculated?

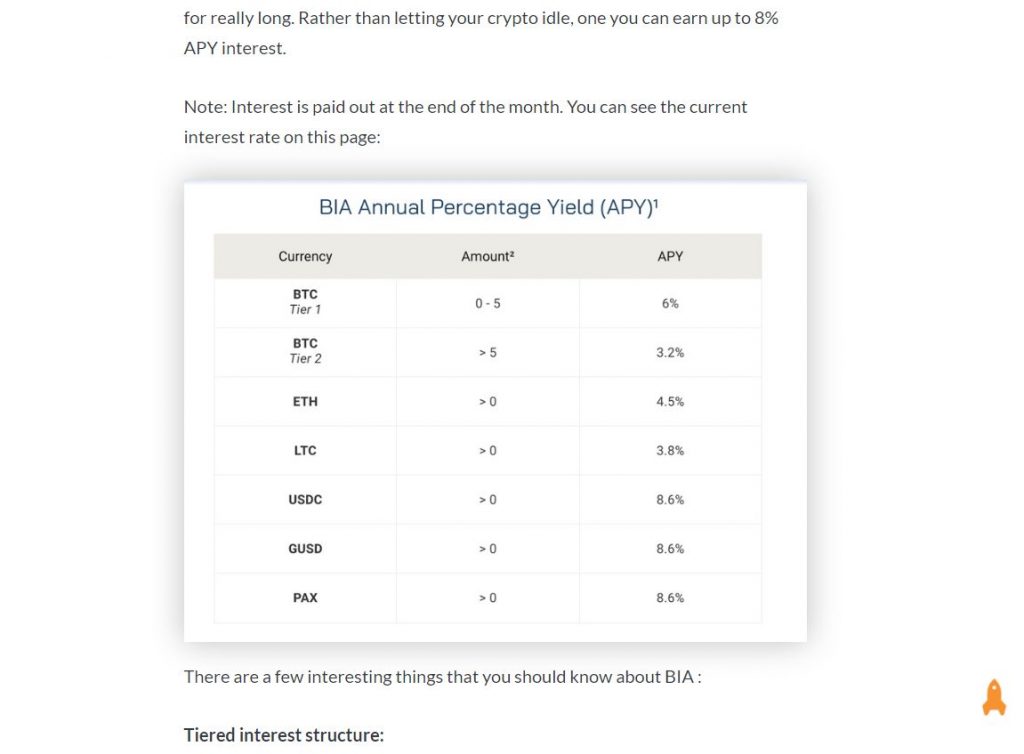

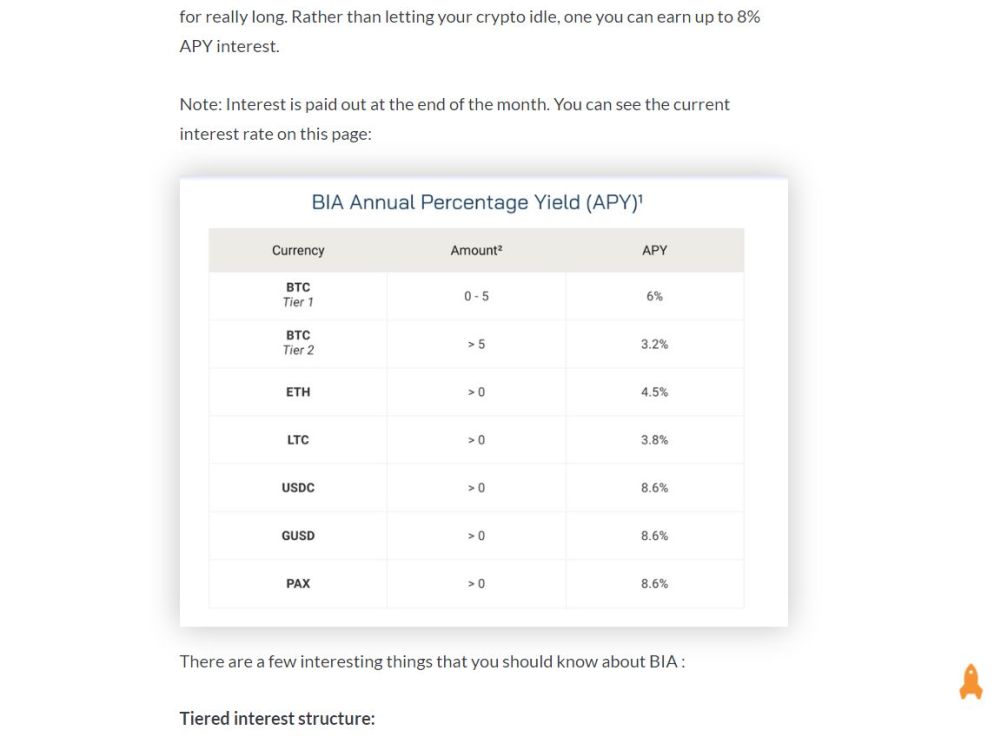

BlockFi offers a tiered interest structure, which allows interest to be calculated based on the cryptocurrency and the number of assets chosen. For the first 5 BTC, you earn 6% but for a balance above 5, you will earn 3.2% APY. The interest rate is subject to change. You can change your preferred interest payment in up to 48 hours before the month ends. (Refer to the table below)

What are the withdrawal limits?

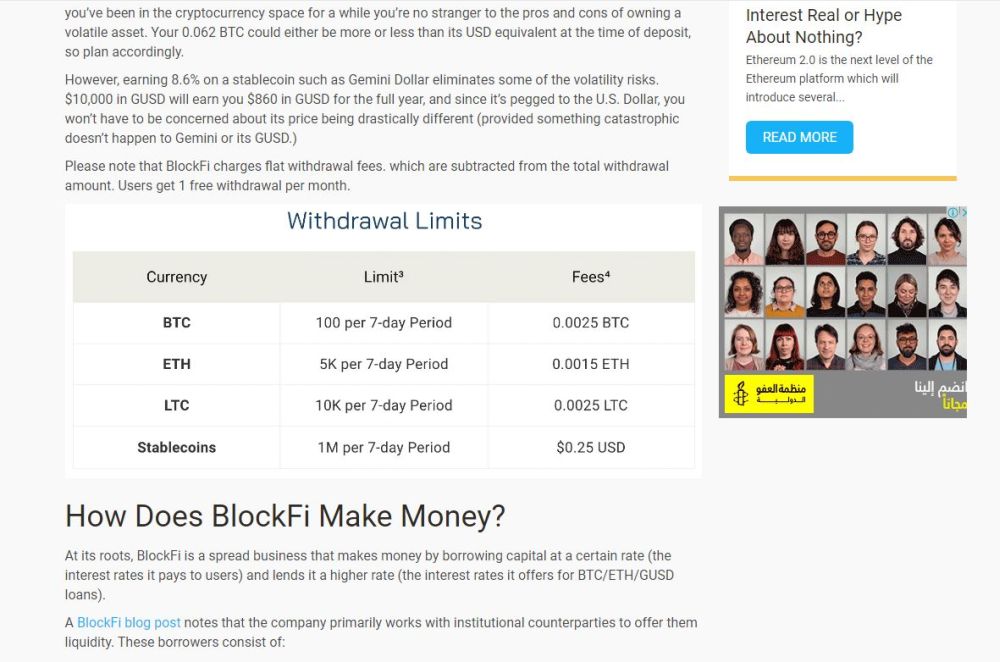

BlockFi aims to charge a flat withdrawal fee and users can avail 1 free withdrawal per month. Stablecoin withdrawals are usually subject to withdrawal with a maximum amount of 1M per 7-day period.

What states does BlockFi work with?

BlockFi is backed by various institutional investors. It works with many states within the US including Illinois, Kansas, Michigan, Pennsylvania, Tennessee, Washington, etc.

What are the annual rates?

There exists a Tiered Interest Structure. The BlockFi interest rates are deemed to be fairly competitive when compared to non-crypto currency. Any changes in interest rates are announced 1-2 weeks before the next month, giving the crypto holders enough time to prepare. Since interest rates vary due to uncertainty in the market, there are no fixed rates. But, annually the rate is as follows:

What coins can you use to earn interest?

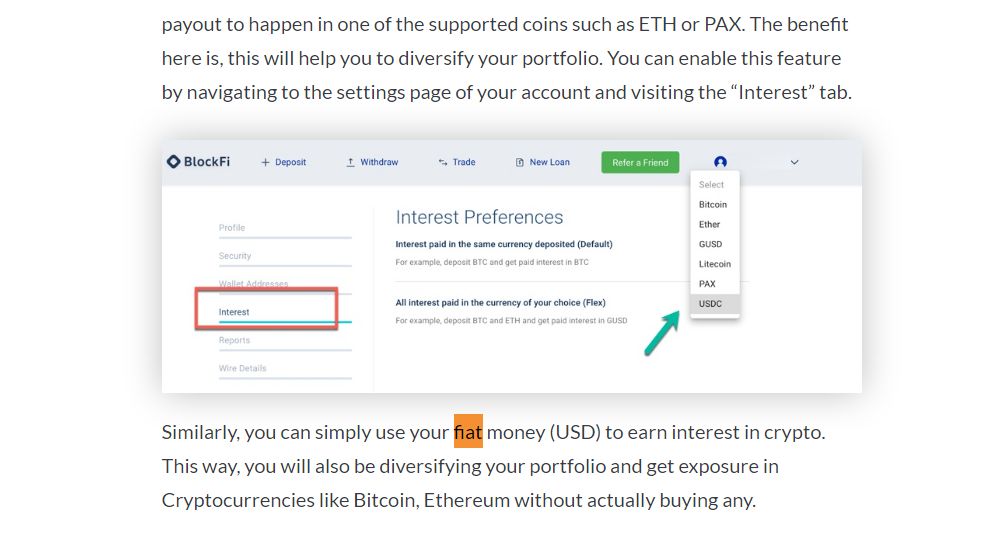

BlockFi uses the feature of Interest Payment Flex, which allows you to pick the coin you want and earn interest on it. The interest rate is 6-8% in Bitcoin and varies in ETH and PAX. You can buy a stable coin like USDC from an exchange from Gemini or Binance, and then deposit this to BlockFi to earn more interest than a bank account. You can also use fiat money (USD) to earn an interest in crypto.

What are the risks?

Risk of security exists and so BlockFi mentions on their website to not view their Interest Account as FDIC or SIPC insured. Also, BlockFi may be riskier than simply storing crypto in your pocket. These platforms should only be viewed as investment instruments to earn interest rate and not fully secured saving accounts.

Is any verification process needed?

Yes, verification is to be ensured. You need to upload a clear photo of a supporting document. Most applications are approved within minutes. But if your application has been pending for more than 48 hours, you can contact their helpline. Even when you request for a withdrawal, verification is required as a security measure to protect your assets and know that the request is free of any malicious activity.

Are there any withdrawal fees?

BlockFi offers one free crypto withdrawal and one free stable coin withdrawal per month. Anything after that time period may lead to a withdrawal fee.

Signing up for the BlockFi app is simple and easy for clients worldwide as you have to make an account that barely takes two minutes. Unless you are from a country sanctioned due to legal restrictions. The steps are:

- Go to the BlockFi website.

- Go to the “Earn Interest” option in the homepage slider, or “Get Started” in the menu.

- Enter your email and make a password to create your account.

- Enter the verification code sent to your email.

- Once logged in, select “Deposit” to verify your identity and make your first deposit.

- Enter your personal information for verification.

- Upload a form of ids such as a passport, driver’s license, or ID card and wait till it’s approved.

- Once uploaded, your application might be approved within minutes.

- If you are experiencing an issue while creating the account, recheck your browser/device settings to see there are no blockers/restrictions. (Note: The following is a list of currently supported browsers for the application: Google Chrome, Safari, Firefox, Internet Explorer 11+)

Crypto Loans

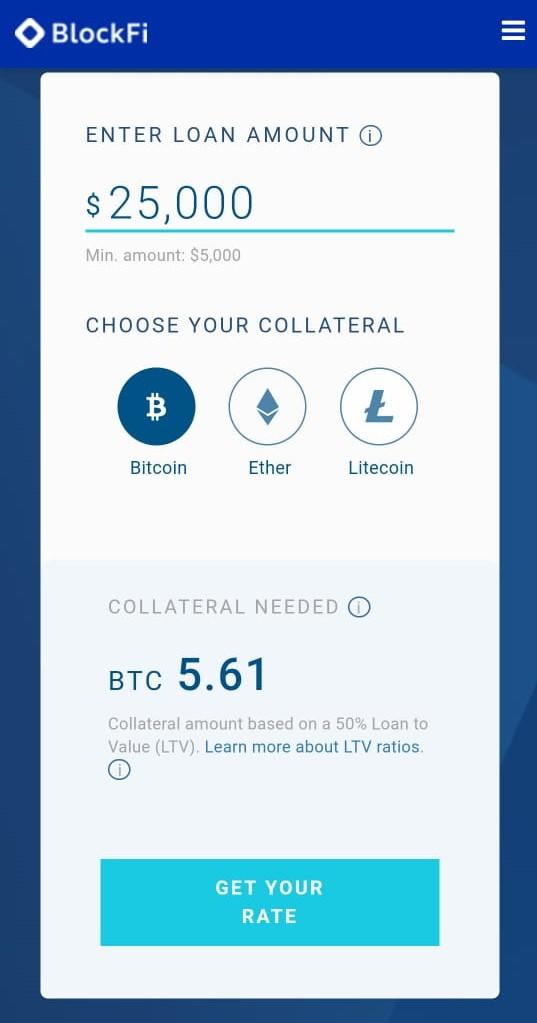

A simple concept found on several sites such as BlockFi is crypto loans. The users are able to borrow assets in crypto as collateral for fiat money or a stablecoin loan. The lender will then have to provide previously agreed upon assets at the decided interest rate. At BlockFi you can calculate your loans on the crypto loan calculator.

What are the rates?

The amount of USD you can borrow depends on the amount of collateral you post against the loan, and which LTV (Loan to Value Ratio) you choose.

Please see below example for a US/Domestic client taking a $10,000 loan (please note the rates may vary for international borrowers)

- 50% LTV @ 9.75% Interest – requires ~$20,000 in crypto as collateral

- 35% LTV @ 7.9% Interest – requires ~$33,000 in crypto as collateral

- 20% LTV @ 4.5% Interest – requires ~$50,000 in crypto as collateral.

What coins can you use as collateral?

This feature lets you take a loan in USD, GUSD, USDC from BlockFi using your crypto assets as collateral.

Are there any tax benefits?

With BlockFi you can get tax benefits on your loans. A loan from BlockFi allows users to use the cryptoassets as collateral. Then users can receive payment in USD to their bank account. If you borrow against liquidity assets it will not trigger a capital gain tax event. Moreover, the interest may also be deductible against the gains and other investments. Other than that the same taxes apply on cryptocurrency as normal.

Are there any risks

You can fund your loan the same business day that BlockFi receives your full required collateral. They fund every business day around 5 PM Eastern time. Please see the key requirements/notes below:

- Fund on Business days (not weekends or US holidays).

- Receive collateral by 4 PM EST in order to fund the same day. If we receive collateral after that, funds would go out the following business day.

- International wires can take 1-2 business days to process and receive depending on receiving institution.

Trading

Crypto trading is a very handy feature introduced by BlockFi recently, and it is useful when users aim to liquidate some crypto assets because of their increased prices and want to keep it in a stable coin. Now the users can further buy back the asset when the price reduces. This is for traders who want to earn interest and trade, by selling when prices are high but buying when prices are low. This exchange of digital currency can be highly profitable but risky at the same time as you can tend to either gain or lose a huge amount of money quickly. BlockFi crypto trade is deemed to be secure and safe for online transactions, but users might want to test the platform before they trust the trading dynamics of it.

BlockFi Institutional Services

BlockFi Institutional Services aims to give financing solutions for digital assets to the consumer market and institutions. This objective was driven to provide cryptocurrency investors with institutional options, inspired by BlockFi’s growth prospects. The CRO, Rene van Kesteren, has been a part of the institutional investment sphere for the past 20 years.

However, the leadership for BlockFi Institutional Services comes from an institutional investment background, rather than from the cryptocurrency industry itself. The BlockFi Institutional Services platform aims to help large, traditional financial institutions to use digital currencies in the most flexible yet profitable capacity.

This initiative is run based on maintaining how digital currencies provide many benefits at scale and they can be promoted just like other traditional assets in consumer markets and financial institutions. This will allow BlockFi to facilitate liquidity and growth not only in the crypto industry but also in the institutional ecosystem.

This means that institutional customers can benefit from the same dedication and value that is shown to the retail clients i.e. crypto users. BlockFi plans to bridge the gap between traditional finance and digital currencies, thus creating more adaptation. The most significant impact of this is to bring a more robust capital market and increased liquidity.

Is BlockFi insured \ Guarantees?

Insurance

BlockFi is not insured in the traditional sense. However, their custody provider is Gemini. This makes Gemini and not BlockFi responsible for storing cryptocurrency assets. The BlockFi interest account is unique because you can grow your holdings. This is also the only crypto storage option that pays interest. It is, however, not protected by the FDIC or SIPC insurance.

Privacy Policy

The BlockFi privacy policy states that it can collect private information shared on their website and through their users’ accounts. This includes personal information like name, address and more. The account information including the details related to cryptocurrency wallets can also be collected. Nevertheless, it does not apply to anonymized data that can be used to identify you. BlockFi collects Non-PII i.e. non-personally identified information which includes information acquired after links are clicked or when something is uploaded. Non-PII can be used to make changes to the website and increase its effectiveness. This information can also be forwarded to marketing and advertising agents.

Terms of Service

The general terms of service are similar to any other website. In addition to those terms, BlockFi has explicitly stated no user can decompile, reverse engineer or extract any information and code by any means. Users can not get involved or violate the operation and security of the products or services. They also cannot be held accountable if the information has not been disclosed by a third-party service provider or agent. According to their license and distribution, BlockFi is not responsible for financial loss pertaining to cryptocurrencies. The exchange rate for fiat currency can change at any time. Users cannot upload any promotional and commercial content to the website without proper authorization. They can also remove, add or edit the content at any time but they aren’t responsible for monitoring it.

BlockFi Support

BlockFi has 24/7 support. There is already information about common queries. Information can be found about its loans, interest account, deposits, trading, withdrawals, interest payments, rates, security and refinance. If the users have any concern that hasn’t already been answered they can talk to an agent as well.

Means of Communication

BlockFi has agents on standby to answer any queries the users may have. There is a support page where users are likely to find answers to their questions already. If they cannot find one there they can always ask the agent and get information about it. BlockFi has customer support team where you can make complaints about money transmission or other complaints.

Talk to an agent directly

It is likely that your query has already been answered which you can search here.

You can leave a request for an inquiry here by submitting a ticket.

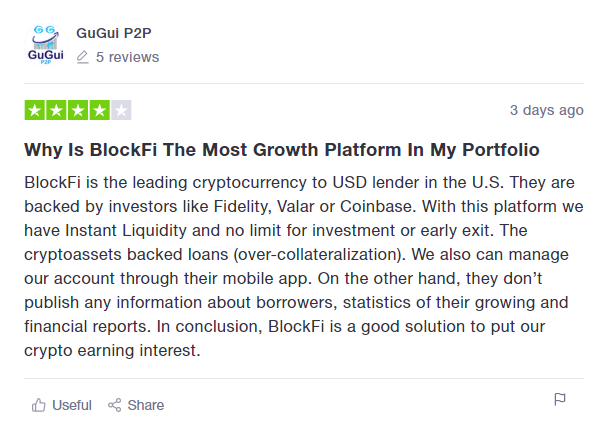

Customer Reviews

BlockFi has witnessed strong customer support due to their prompt sales and after-sales services. They have made themselves available to answer questions or concerns through the phone.

| Support | 4 / 5 |

| Rates | 4 / 5 |

| Loyalty | 5 / 5 |

| Customer Reviews | 5 / 5 |

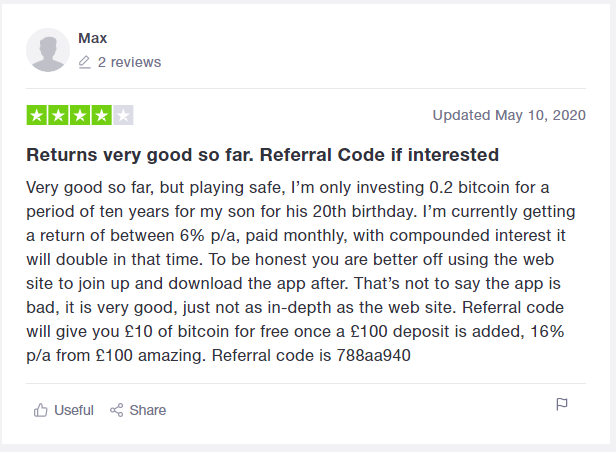

There are several positive reviews online such as the ones below

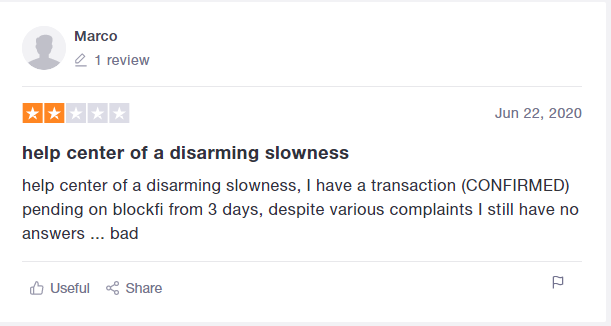

Nevertheless, there are negative reviews as well such as the one below.

This and other similar reviews indicate that the BlockFi claim of giving its user back good interests on it investments carries weight and appears to be true. More users have highlighted this as the most positive part of their experience. However, as evident from the negative review the lack of instant withdrawal has made some people unhappy with their experience on BlockFi.

FAQ HERE

Conclusion

The BlockFi Review comprised of the team, product, communication and business model evaluation. In the world of cryptocurrency, BlockFi leads as an example amongst others. It is an innovative platform that has allowed worldwide users to gain financial services in terms of the trading of crypto assets or earn interest. As a growing firm, it has attracted many renowned venture capitalists to invest, thus, strengthening its position in the crypto market.

If I analyze, the risk of the counterparty or a catastrophic hack exists. But, BlockFi might still be a platform for you! It is secured by companies like Gemini Trust. In the coming years, BlockFi app may grow and become the market leader. One aspect they could work on is the withdrawal feature, by offering more power to the crypto users.

Overall, BlockFi signals to be a well-founded application for crypto borrowing and lending. As the world is becoming more of a global endeavour, cryptocurrency will also provide a much-needed diversification of revenue.