Celsius Network has been on the financial headlines with its big promise, attracting massive attention from crypto traders. Guaranteeing a 4-10% APY annual return is quite a big promise to make to stakeholders, which many have termed as unreal. However, in this article, you get an in-depth overview of Celsius services, highlighting both the good, the bad and the hype. By the end of this review, you will understand clearly whether the company can deliver its big agenda to the members or not and if it does, how it does it.

- There is no minimum deposit.

- No withdrawal fee feature.

- Freedom to choose how to receive or pay your interest.

- Celsius Network does not lock the funds of the users.

- No Credit Check

- $25k Limit on Immediate Withdrawals

- They do not offer a downloadable earning statement.

Is Celsius the Right Place to Shape the Future (Pros & Cons)

Is the Celsius network a scam? Discover the thrilling facts about the renowned crypto lending platform that many have no idea about. I cover both the good and the bad of the company.

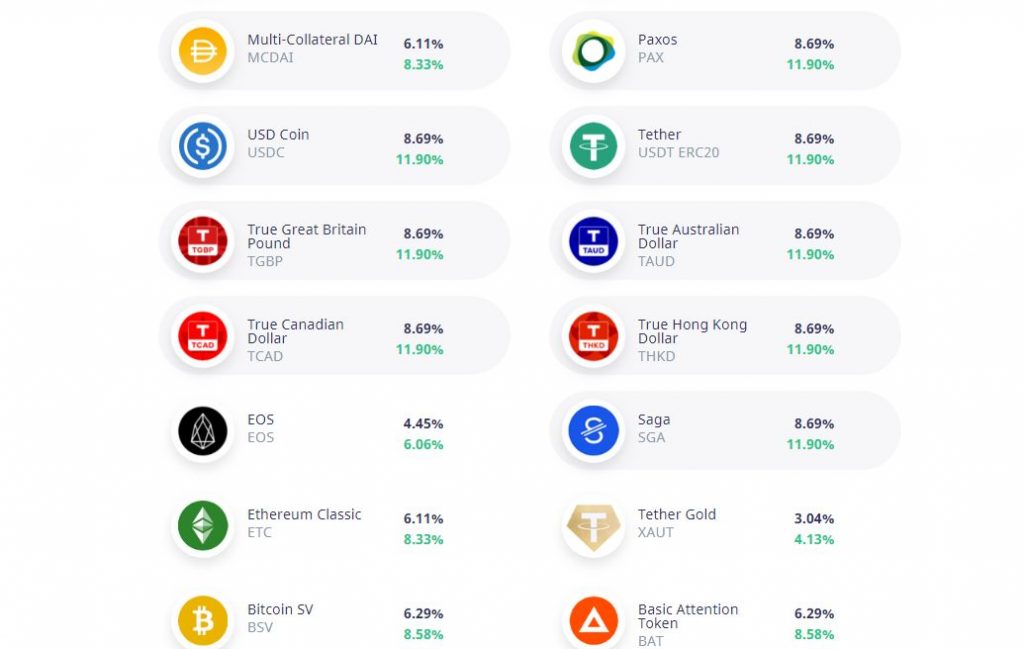

Celsius Network Interest Rates:

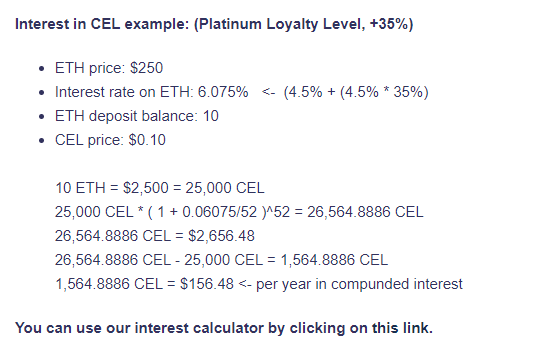

Celsius has two kinds of rates it offers to its members; one with CEL Tokens and the other without. The company pays its members who use CEL more interest than those who do no. Therefore, to earn the advertised rates, one needs to use CEL. The interest rate goes up to 11.90% for stable coins.

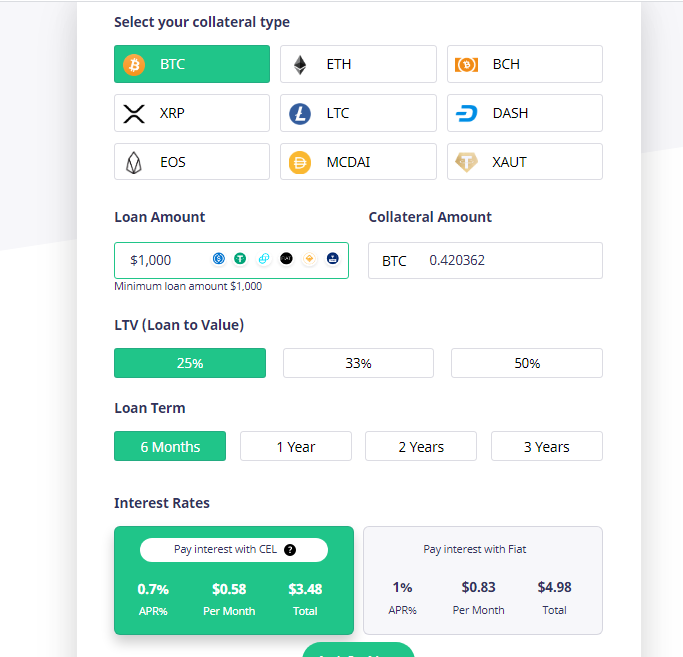

Celsius Network Loan Rates:

Celsius makes money by lending the community’s resources as loans. The interest they receive in turn acts as the revenue to drive the company. The company has loan interest rates as low as 0.70%*

1. Overview of the company

Celsius Network is a cryptocurrency lending platform that has grown to be one of the largest crypto lending companies since 2017. In the orthodox cryptocurrency programs, whenever you need to use the savings in your account, you’ll be compelled to sell your savings at a ridiculously low rate. However, Celsius Network comes in handy to help cryptocurrency investors apply for a soft loan placing their savings as collateral. Doesn’t that sound amazing? Not many platforms would invent such a promising platform. In this way, they no longer need to sell their savings at low prices.

It is fair enough to take a loan and pay it with a 1% interest while still having your savings, rather than selling your shares at pathetic prices. A lot of people have been asking whether the Celsius Network is legit or a scam. Consequently, I decided to write a Celsius Network review giving an overview of its structure, pros, and cons.

Unlike other financial institutions, Celsius Network provides its members with curated services that are not offered by traditional institutions. According to their portfolio, their main goal is to be a catalyst for global financial disruption by offering unique and quality services that will bring the next 100 million people onboard.

Is Celsius Network safe to use?

Absolutely. With the alarming rise of scammers in the crypto industry, everyone should be worried about the security of their investment. Many crypto lending companies make empty promises, only to walk away with their members’ investments. However, Celsius’ numbers and financial records are promising and tantalizing. Aren’t they? In terms of numbers, the company owns a ledger of $8.2 billion in terms of loan origination, more than $705 million in assets, and more than 124K active wallets. For a company that was founded in 2017, this is quite an exponential advancement. It certainly is one of the fastest-growing cryptocurrency platforms globally. For those wondering, “Is Celsius Network safe?”, look at their numbers. They are more transparent about their security than most institutions.

To use Celsius, one needs to download its mobile app, which is compatible with all android and iOS phones.

The success of Celsius Network cannot be mentioned without including the driving force behind the idea, Dr. W. Scott Stornetta, the original inventor of Blockchain and Alex Mashinsky, the CEO of the company. Among other key players include Daniel Leon, the Founding President and COO of the company, Harumi Urata-Thompson, the CFO, and Nuke Goldstein, the CTO.

The company has implemented a customer-friendly interface with a reliable team of staff ready to help its members. Additionally, they have a qualified team of support staff that takes the company’s weight by their shoulders, ensuring the smooth running of the company.

2. Pros and Cons

It is essential to critically analyze the pros and cons of the company and come up with a solid conclusion.

Pros

- There is no minimum deposit. Celsius Network believes in equality for all people. As a result, they give their members the freedom to deposit whatever amount they want. As in their policy, they act as a disruption in the financial world to create a platform that will favor everybody, both the big money depositors and the beginners interested in making it in cryptocurrency. In a nutshell, Celsius Network is by the people for the people.

- No fee feature. This is a rare, if not unseen feature for the financial institutions. The company does not charge its members any fee for the following:

- Origination fee

- Withdrawal fee

- Early Termination Fee

- Default fee

- Freedom to choose how to receive or pay your interest. The company gives the members the freedom to get their interest in-kind (the crypto you deposited) or in CEL tokens, the native token of the Celsius platform. Choosing the latter gives the users a 30% interest gain. What more could anyone look for?

- Celsius Network does not lock the funds of the users. This is of the best if not the best features I have come across in any cryptocurrency platform. Unlike other platforms, Celsius gives you the power to control your funds. Other orthodox platforms require you to lock up your savings for a while if you want to earn interest. With Celsius, you are free. Isn’t that amazing? I mean, it’s a rare feature you cannot find anywhere else. You are free to withdraw.

- No credit Check – When taking a loan, you put your crypto as collateral. Therefore, your banking history is unnecessary. They need not check on your credit score to give you a soft loan.

Cons

- $25k Limit on Immediate Withdrawals — For withdrawals exceeding $25K, you will need to contact the customer services to have it processed. In most times, such a withdrawal could take up to 24 hours to process. This aspect ensures better security, but again, it’s less convenient for users.

They do not offer a downloadable earning statement. Currently, all interest earnings are listed in the app under each coin or consolidated into a list. This is the only way you can view your earnings.

3. Celsius Network services

Celsius Network enables users to earn interest in their invested coins and apply for loans using their savings as collateral.

Celsius Network Earn Interest

According to the company, 80% of its income is shared among its users, not stakeholders. As a result, the company can pay users a rate of up to 12% APY. This is quite a big return compared to other platforms. In fact, not many platforms offer such a generous return to their users.

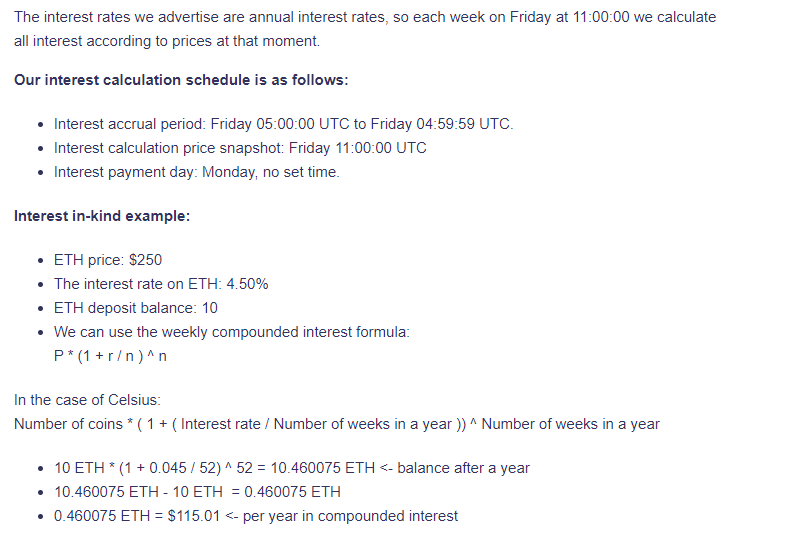

Interest is earned weekly and is deposited in the user’s wallet every Monday. The company calculates interests every Friday at 11:00. Like other platforms, Celsius uses a compound interest formula to calculate the weekly interest.

P * (1 + r / n ) ^ n

It is important that you understand the interest is an annual interest.

For the interest in CEL, the company used the following method.

Withdrawal limits.

Now that you have earned your interest and want to withdraw the money, the big question comes, what are the withdrawal limits? Normally, you cannot withdraw less than $1. Their withdrawals are instant up to $20000 and can be done from the phone app. Above this limit, one has to withdraw manually by contacting the customer support to make the withdrawal, and this could take up to 24 hours( 48 hours in rare cases). It could inconvenience some people, but it safeguards your money. Celsius has a daily withdrawal limit of $50000. You cannot withdraw more than that amount in a day.

Coins used for interest earning.

Celsius currently has seven leading cryptocurrencies to purchase through their app. These include:

- Bitcoin

- Ethereum

- Litecoin

- XLM

- Bitcoin Cash

- SGA

- XRP

What are the rates?

Celsius has different rates for different coins

Ethereum- 5.9% APY

Bitcoin-5.47% APY

Dash-8.43% APY

Bitcoin cash- 5.19%APY

Bitcoin SV-8.58% APY

Litecoin- 5.62% APY

XRP- 4.91% APY

USD Coin- 11.90% APY

TrueAUD- 11.90% APY

Do I need to do a verification?

Absolutely. Celsius does KYC for all its members. KYC is an abbreviation for knowing your customer, a standard practice for any financial institution. The purpose of verifying your identity is to discourage money laundering and other illegal activities that could threaten the reputation of the institution. It is necessary to keep the business ecosystem safe and legal for the harmony of the operations.

Are there any withdrawal fees?

How would it feel saving your account the dent of hefty withdrawal fees? Fantastic, right? If you are looking for a platform where you will not incur hefty withdrawal charges, Celsius is the best option for you. As a matter of fact, Celsius does not charge any fee for withdrawal. This is an added advantage for members.

What are the investment periods? Are there any limits?

Like I said before, Celsius does not lock-up savings for its members. Once you buy or deposit your coins, you start earning instantly. All the weekly interests are deposited in the wallets of the users every Monday. This is unlike other platforms that require you to lock up saving for a while in order to start earning.

Celsius Network Loans

Applying for a loan has never been made easier than with Celsius Network. You simply need to go to the app, select the crypto you want to use as collateral and for interest payment, the quantity you want to place as collateral, the term, and the USD amount. The transaction is only as fast as 30 seconds, with no credit checks, no transaction fee involves, no termination fee, but instant approval.

The company gives the users loans on 25%, 33%, or 50% of their collateral value. The core purpose of this is to protect the lenders and ensure the effective running of their operations. The minimum amount of loan one can apply for is $1000.

Celsius offers its users with dollar loans to access the value of their digital assets without selling them off. This allows the members to place their coins and investments as collateral. Members can use BTC, ETH, XRP, EOS, DASH, BCH, LTC, and XAUT*.as collateral for their loans. With this feature, your investments still continue earning interests as you pay the loan.

What are the rates?

The loan interest starts as low as 4.95 %, depending on your loan to value ratio. The more the coins put as collateral, the less the interest. The vice vasa are equally true. This is quite a fair rate compared with other financial institutions’ rates.

Requesting a loan on the app is very straightforward, where it can take you only up to 30 seconds to process. For the dollar loan, disbursement is done as soon as the loan is approved depositing to your account can take up to 24 hours. For international members, the transfer could take up to five business days, depending on the recipient’s bank policy. Stable coin loans are deposited directly into the Celsius wallet, and the members can now access them easily. To be honest, I am quite impressed by the effectiveness and convenience of the company’s services. It’s a rare case to find a platform that is equally effective and supportive of its members.

Are there any loan repayments?

Like any other loan, you must pay. Celsius has a standard loan agreement terms of 6 months as well as 12 months. However, the terms do not limit you from paying the loans earlier. You can choose to pay the interest on:

- CEL ( up to 30% discount on payments in CEL token )

- Crypto ( any coin that they support in the app and that you have on your account )

- US Dollars

Are there risks involved?

Yes, there are. Your coins and savings are the risks you take when requesting a loan. In case you default to pay the loan, the company has the authority to liquidize your collateral to pay the loan. However, this only happens in rare cases.

In the event, the market of your collateral goes high and gains more value; Celsius is convenient in ensuring the excess collateral is deposited to your wallet to continue earning interest. This is a rare feature to find in blockchain platforms if not unseen. You could also request to borrow more on the excess collateral. Isn’t that fulfilling?

You are required to pay the loan’s monthly interests, but that does not limit you from paying the loans before the required date. You must always pay your interest on time to avoid penalization or liquidation of your collateral(In case of defaulting). One more interesting fact about Celsius loans is that there is no credit check. When you are requesting a loan, you place coins as collateral, so checking your credit score is unnecessary. However, I do not advocate that you maintain a bad credit score with your banks.

When will my first payment be due?

Celsius offers its members loans on either 6 or 12 months terms. Your first payment could be due in six months or 12 months depending on the term you chose. However, you are not limited to paying the loan earlier should you have the money.

Is there verification needed?

For you to receive a loan, you will need to have done a verification. To do that you will need either of the following depending on your country:

- Passport.

- National ID card.

- Drivers license.

This is commonly known as KYC.

Compounding Interest On Gold

Gold is a rare commodity that has sustained its value over centuries. As a result, it has gained unlimited FIAT printing by all central banks. Celsius allows you to earn upto 3% APY interest. The appreciation of Gold with time can earn you huge profits, thus makes the best commodity to put your savings on.

CelPay

What makes Celsius quite different from other crypto lending platforms?

While many crypto lending platforms use credit cards or similar perks, Celsius has CelPay, a crypto sending app that allows the users to send coins free of charge. Sending Crypto coins to people without a wallet has been made easy using CelPay. In this case, the app generates a unique link that holds the wallet to the recipient’s coins.

With CelPay, the members enjoy fee-free services in almost all the transactions. CelPay gives its users the advantage of sending coins to other users for free, withdrawing freely as well as enjoying instant transactions. This is a rare feature in the market. Needless to say, there are no matching services yet in the industry.

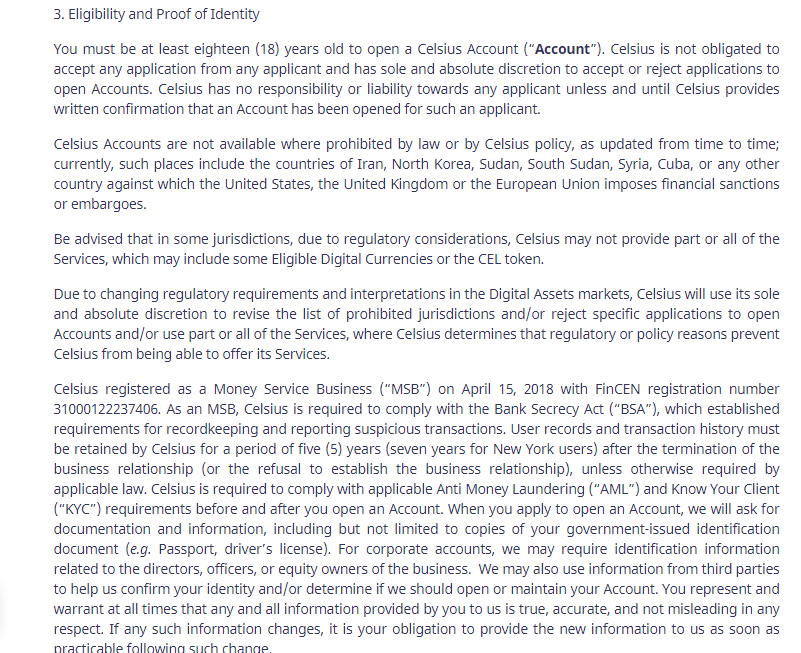

4. Is Celsius Network legit?

Ensure you understand the terms of service as well as their privacy policy before rendering a verdict on the credibility of any company. To open a Celsius account, one requires a minimum age limit of 18 years. The company is not liable or responsible for accounts that are prohibited by law or by Celsius policy. This is proof enough that Celsius operates in the bounds of the law.Like any other financial institution, Celsius is registered as a Money Service Business with FinCEN registration number 31000122237406 and is required by law to comply with the Bank Secrecy Act. I find the company quite transparent about its legitimacy in terms of use. Not many companies will publicly give their registration details as Celsius has done. This answers the question better and satisfactorily. Yes, Celsius Network is legit.

The company provides several means of communication should you have any queries. They provide email support as well as their hotline number. Like many other companies, Celsius has online chats as well, where they employ a team of dedicated support staff to provide online support.

CEL Token

In 2018, Celsius Network launched an ERC-20 utility token called Celsius (CEL), that can be purchased on exchanges like Liquid and IDEX. When the token was launched, it raised $50 million but is currently valued slightly less than that. The total supply is 650m, with more than 50% of the coins issued. 25% went to the team, and the rest is held in a locked smart contract that will only release these coins to be used for new loans if CEL is valued at greater than $1.50 for longer than ten days, and then greater than $3 for 30 days.The company uses CEL as a stake in its app to primarily calculate the weekly compounding interest. CEL stands as the highest interest scheme in the platform. Using CEL earns up to 30% discount on loan interest payment, and an additional 30% on staked assets when receiving on CEL. If the Users wish to earn the highest rates, they need to hold 30% or more of their crypto in the app as CEL, incentivizing users to HODL the token.

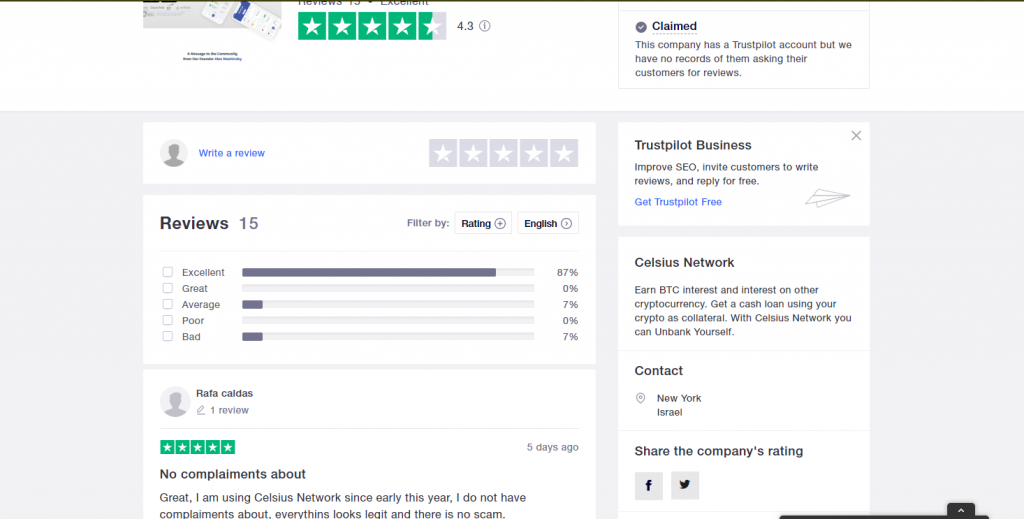

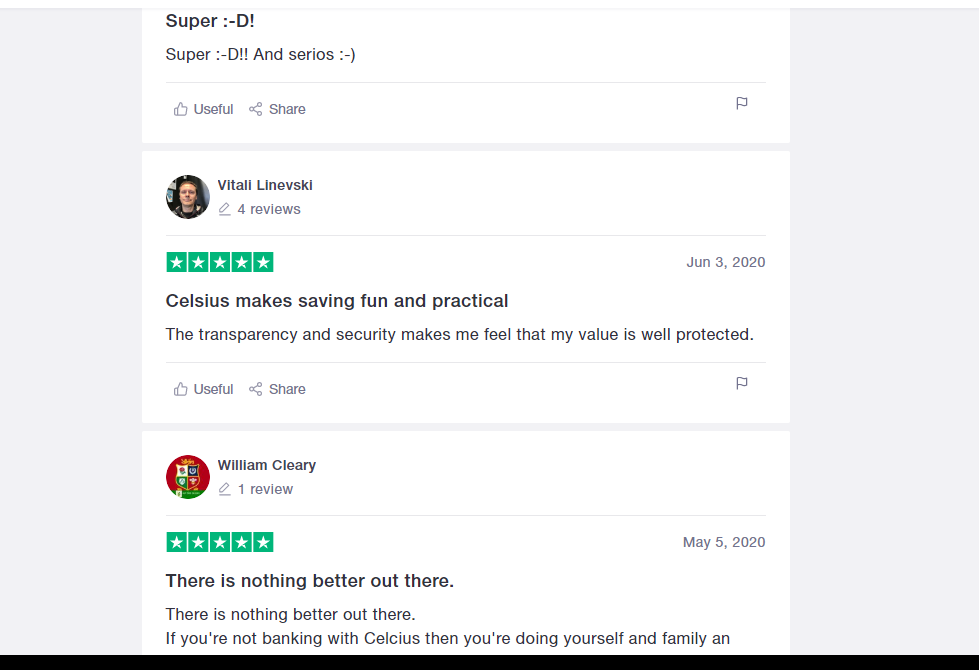

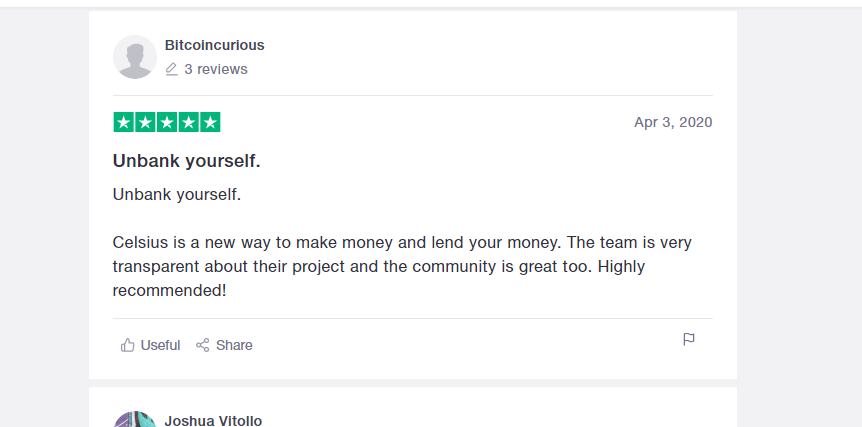

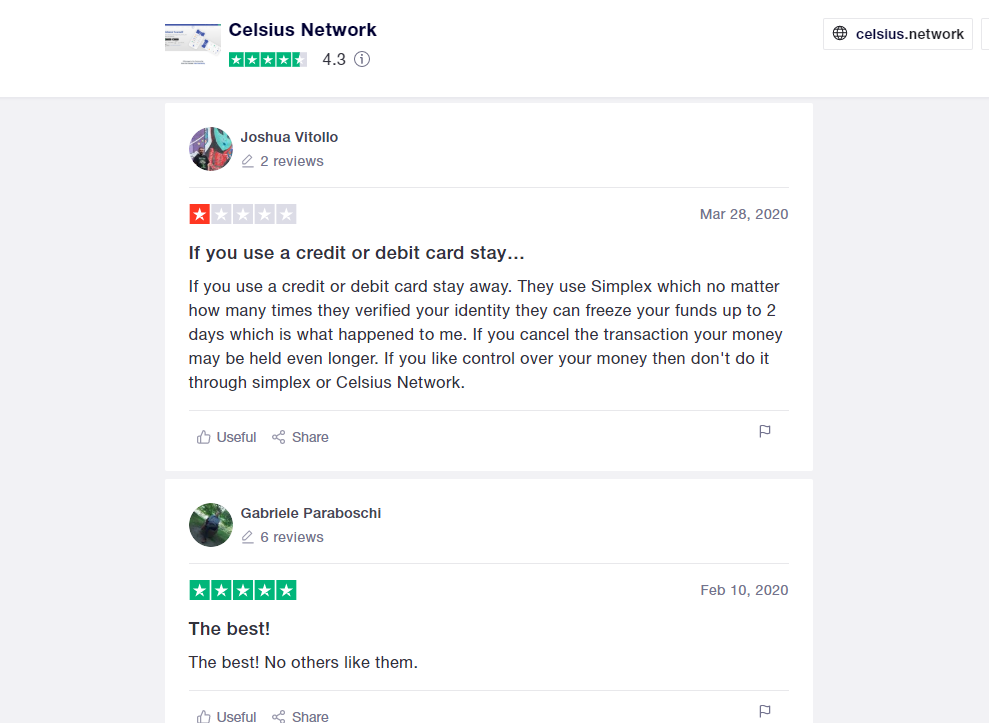

5. Customer reviews

When coming up with a review, I always conduct a thorough research on the good and the bad side of credible data. That involves checking for both good and bad reviews. In my years of experience in reviewing financial institutions, it has been rare to find a company with only positive customer reviews. I took a survey at various review platforms, and the results were amazing. There were a lot of positive reviews and only a few negative ones. The unmatched dedication of Celsius Network in creating a conducive environment for all has seen many people rate the company positively in many platforms.

Above is a summary review at Trustpilot. More than 87% of the customers were satisfied with the services provided by the company.

From most of the reviews, it’s evident enough that most customers trust the services offered by the company. The company has invested a lot in creating its brand, and that has been the key factor behind their positive brand image.

6. FAQ HERE

7. Conclusion

This review is meant to create an overview of the Celsius Network purposely. It took me time to research the company in detail and understand their services and mode of delivery. Should you be considering investing in the company, you already know what Celsius is, how it operates, and the benefits its members enjoy. If you are seeking a recommendation or approval, I would highly vouch for the company, given their positive dedication to serving the members. The company is legit and reliable. Moreover, Celsius provides quite a conducive platform to grow your future in. Nevertheless, to be the part of the global solution to the contemporary financial challenges that Celsius aspires to address, investing is a personal decision that one needs to make soberly without influence.