Crypto lending is opening up a new range of possibilities for depositors and borrowers. Several crypto-lending platforms are competing to come up with innovative solutions to attract investors.

Among them, Aave is making a wave in the market with its most extensive options of assets for lending and borrowing. On top of that, you can also take advantage of loans without collateral.

Excited to know more? Let's find out more in our Aave review!

- Great rates in the industry

- Pioneers of the DeFi movement

- A wide range of assets to lend and borrow

- Used by a huge number of people

- Zero collateral loans

- Not very user-friendly

- Need technical knowledge to avail flash loans

| Support | 3.5/5 |

| Rates | 4.5/5 |

| Loyalty | 4/5 |

| Customer Reviews | 4.5/5 |

| Total | 4.5/5 |

Aave Loan Rates

- Stable rate: 3% to 9%

- Variable rate: 0% to 7%

Aave is a pioneer of the DeFi industry and started its journey in 2017 as ETHLend. Founder Stani Kulechov was able to raise $16 million in Ether by handing out 1 billion native LEND tokens.

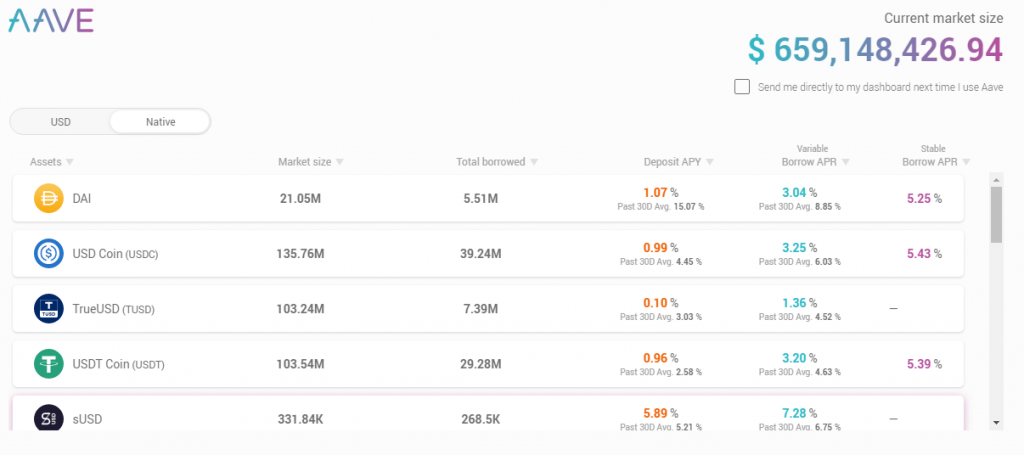

The company is popular for transparent fees and being a reliable protocol for lending and borrowing. In 2018, the company rebranded itself as Aave with a total of 17 assets for investing. At the time of writing, the value of Aave crypto volume is $ 675,618,399.51.

You can take advantage of Aave both as a lender and a borrower. Depositors can earn a passive income, while borrowers can avail over-collateralized or under-collateralized loans.

2. Detailed Pros and Cons

Aave is a great platform to lend and borrow crypto. You can use simple ways to earn or borrow assets by connecting your wallet. The platform has good support and even lets you chat to resolve any issues. You can take advantage of low loan rates and earn handsome interest while lending.

Aaave is continuously improving and releases new features frequently. It’s a great choice if you want to easily grow your assets or borrow crypto.

3. Aave Services

You can use the services of Aave as a lender or borrower. We will explore both aspects to give you a clear idea of how the platform works.

Aave Earn Interest

Aave lending can be a good way to earn interest on your crypto assets. You can start earning interest just by depositing your capital on the platform.

How does Aave (Lend) work?

The process is really simple, and you don’t have to take any headaches. Just add your deposit and generate earnings on your assets. You don’t even have to go through any verification process.

Earning Rates

Depositors can enjoy non-stop earnings based on market conditions. You can earn in two ways through Aave Lend-

Interest on loans: Borrowers pay interest on loans that vary according to borrowing periods and utilization rates. You can expect more income when the utilization of reserves is higher.

70% of flash loan fees: You get a share of the flash loan fees. This corresponds to .063% of the flashloan volume.

Withdrawals

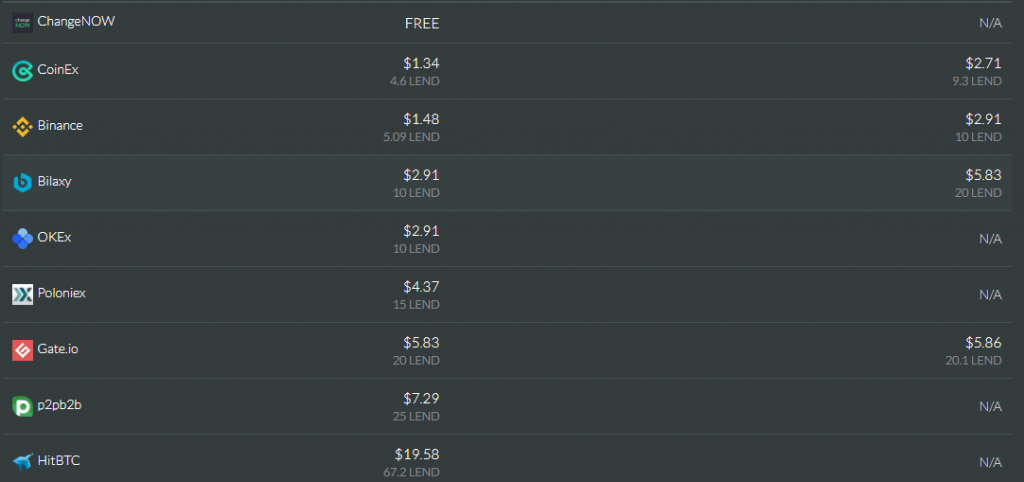

You can withdraw funds easily by going to the “Deposit” section of your account. There are no limits on withdrawal, and you can enjoy zero fees by using LEND.

Here is a look at the withdrawal fees:

Investment Period

You can start earning interest as soon as you make your deposit on Aave. As of now, there seems to be no lock-in period or fixed time for your investments.

Probable Risks

Like all crypto-lending platforms, Aave carries a few risks. Common risks include-

- Smart contract risk (technical issues)

- Liquidation risk (risks related to process of collateral liquidation)

However, Aave makes every effort to cut back risks and improve reliability for its customers.

How to Lend on Ave

Step 1

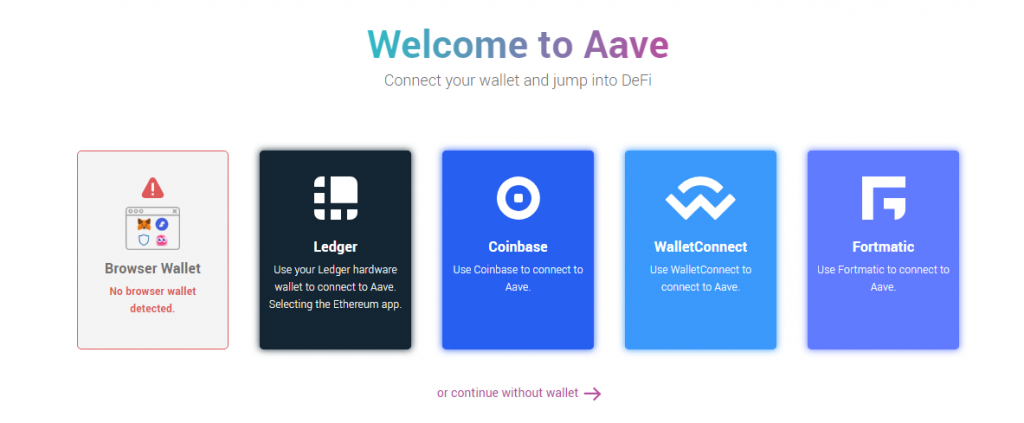

Visit Aave deposit page to make your deposit. You can do this from any internet browser.

Step 2

Connect your wallet with Aave to proceed with your deposit. You can use popular Aave Lend coins wallets like Coinbase, WalletConnect, and Fortmatic.

Step 3

Next comes the turn to make your deposit. Just click on an asset and enter the amount you want to deposit. Now, grant approval to Aave for accessing the selected asset.

Congrats! You can now start earning interest right away!

Aave Loans

Borrowers can take advantage of two types of loans from Aave-

Traditional collateral loans: You can take loans in crypto or fiat by depositing collateral. The amount of loan you can take varies on the collateral amount and a few factors.

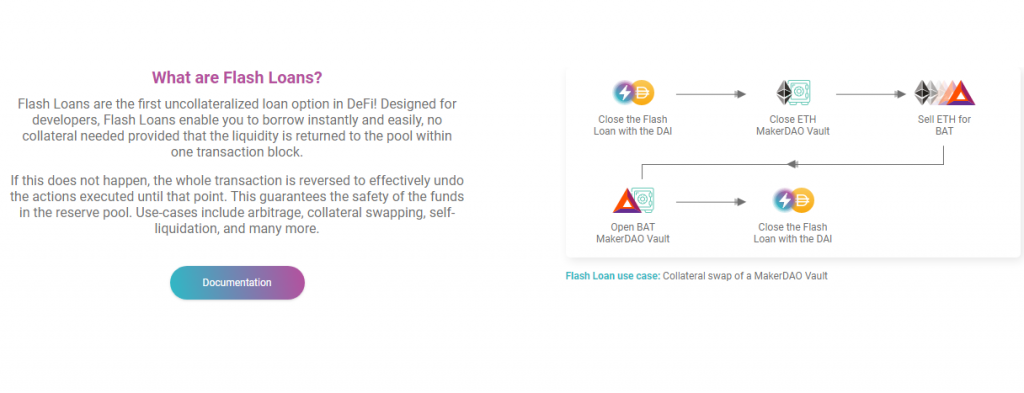

Flash loans: Flash loans are zero-collateral loans aimed at developers. You can borrow any amount instantly without hassles, provided you pay back within a single transaction block. If you don’t, all actions until the point of no-payment are reversed to protect the funds.

Borrowers don’t need to go through any formal verification process.

Interest Rates Payable

You can borrow from Aave through stable rates or fixed rates.

Stable rates are fixed rates for the short-term. However, they can be adjusted for the long-term based on market conditions.

Variable rates vary and are based on supply and demand in the market. You can change your interest rate any time you want.

Payment Period

A great thing about Aaave is you don’t have any fixed period for paying back loans. This applies to both flash loans and collateral-based loans. As a result, you also don’t have any payment due dates.

However, the more you delay your payment, the more will be the interest accrued.

Probable Risks

You don’t have any probable risks when it comes to taking loans. The amount you borrow comes from a huge pool of funds put together by the depositors. You can safely borrow and payback without any worries on the platform.

The only risk can be due to technical issues on the platform.

How to Take a Flash Loan

Flash loans are primarily meant for developers. You need a good understanding of cryptocurrency, Ethereum, smart contracts, and coding to get flash loans.

Step 1

Get a thorough knowledge of crypto technologies and brush up your coding skills.

Step 2

Read the complete documentation for taking your flash loan. You can access the information here.

Step 3

Develop your code and implement following the instructions in the documentation. You can also use resources like CollateralSwap and DeFiSaver to directly utilize your flash loans.

4. Is Aave Legit

Whether you borrow or lend, Aave is a reliable and secure platform. It also has a live chat and subjects the platform to audits. No one has ever complained about Aave or called it a scam.

You can safely borrow or lend on Aave with complete peace of mind.

5. Customer Reviews

Customers are really satisfied with Aave, including both lenders and borrowers. Most of them are happy about the simple way of earning interests by just making a deposit. Borrowers, on the other hand, are impressed with flash loans that come without collaterals. Most of the reviews are positive and say good things about Aave.

6. FAQ HERE

7. Conclusion

Aave is a reliable platform to earn interests or borrow crypto. You can safely make your deposit and earn interests instantly without hassles. Borrowers can also take loans using collateral or go for zero-guarantee flash loans. You are sure to have a satisfying experience with optimum efficiency and security.